Corporate Control

The markets for genetically engineered (also called genetically modified or GM) crops are dominated by four seed and agrochemical companies. The high level of corporate concentration in the seed market has already meant higher prices, limited choices for farmers, a narrowing of genetic diversity in crops, and stagnating innovation.

“It boils down to power. When just a few firms control nodes of food supply chains, they have the power to shape what our food system looks like, how much choice and voice we have within it, as well as our access to a healthy and sustainable diet.” – Jennifer Clapp and Keldon Bester, The Monopoly Problem at the Heart of Canada’s Food System, 2025

Corporate Concentration

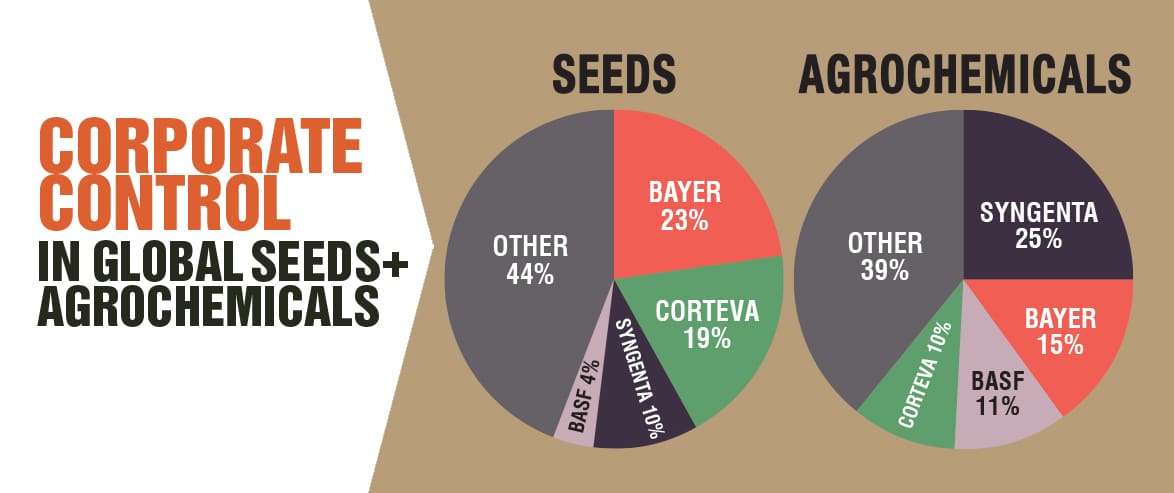

The markets for genetically engineered (also called genetically modified or GM) crops are dominated by four giant seed and agrochemical companies. These four companies – Bayer, Syngenta, Corteva and BASF – now control 56% of the global seed market and 61% of the global pesticide market. Before Bayer bought Monsanto in 2018, Monsanto was the world’s largest seed and biotechnology company, and Bayer was the world’s second-largest agrochemical company.

- The two largest seed companies, Bayer and Corteva (DowDuPont), now control 42% of the global commercial seed market.

- The two largest agrochemical companies, Bayer and Syngenta, now control 40% of the global agrochemical market.

- Bayer, after buying Monsanto, owns 23% of the seed market and 15% of the agrochemical market. Report: Bayer’s Toxic Trails: Market power, monopolies, and the global lobbying of an agrochemical giant, Corporate Observatory Europe, September 2024

- Syngenta now owns the one quarter of the global agrochemicals market.

- Corteva Agriscience owns 19% of the global seed market and 10% of the agrochemical market.

- BASF now owns 11% of the agrochemical market, after buying assets from Bayer that Bayer was required to divest in order to purchase Monsanto. BASF now owns Bayer’s glufosinate-ammonium herbicide (brand name “Liberty”) products and the GM “Liberty Link” seeds that are tolerant to it.

- The company FMC now owns 6% of the agrochemical market, after buying the pesticide assets DuPont had to sell in order to get regulatory approval from the European Union for its merger with Dow.

Source: GRAIN and ETC Group, 2025.

These companies control most of the genetic engineered seeds planted in Canada and around the world:

Of the 33 GM herbicide-tolerant crops approved for growing in Canada that could be on the market (there is no government tracking of plantings): 22 are owned by Bayer, 6 by Corteva (DowDuPont), and 3 by Syngenta (ChemChina).

In 2007, before the new mergers, the six largest seed and agrochemical companies (Syngenta, Bayer, BASF, Dow, Monsanto, and DuPont) accounted for over 98% of all GE crop acres in the world. Monsanto’s GE traits were approximately 85% of the total GE acreage.

Between 1996, when the first GE seeds were introduced, and 2011, the market share of the world’s three largest seed companies more than doubled, from 22% to 53%. The share of the top three agrochemical companies grew from 33% to 52.5% in the same period.

Several of these companies also regularly “cross-license” or share their patented traits with each other, reinforcing their market power. About half of all commercial GM seeds with stacked traits are the result of cross-licensing between companies.

Source: ETC Group

Corporate Mergers

“Mergers among competitors played a significant role in increasing concentration in the seed sector…Opportunities to commercialize innovations in agricultural biotechnology and stronger protection for intellectual property rights over seed and related agricultural biotechnology innovations were major driver of seed sector consolidation.” – US Department of Agriculture, Concentration and Competition in U.S. Agribusiness, 2023.

Between 2017 and 2018, a series of mergers took place between the largest seed and agrochemical companies in the world:

- Dow and DuPont merged to form a new company called DowDuPont and created an agricultural division called Corteva Agriscience. Corteva became a stand-alone company in 2019.

- China National Chemical Corporation (ChemChina) bought Syngenta. Over the course of 2020 and 2021, the Chinese chemical company SinoChem merged with ChemChina, and combined their agricultural assets under the newly-formed Syngenta Group.

- Bayer acquired Monsanto for US$63-billion. Monsanto’s name was dropped, and the joint company is now called Bayer.

Canada and other governments had to approve the mergers before they were finalized:

- Read CBAN’s Comments to Canada’s Competition Bureau objecting to the Bayer-Monsanto merger, September 2016.

- Read CBAN’s Press Release: Canada’s Decision to Allow Monsanto’s Mega-Merger with Bayer Worries Farmers, Environmental Groups, May 31, 2018.

Impacts

“Such a heavily consolidated seed and agricultural input industry makes it easier for cartel-like tacit collusion that raises prices for farmers and other buyers and ultimately consumers while stifling innovation that is propelled by healthy competition in the marketplace. Predictably, more concentration of power and less competition will lead to reduced responsiveness to documented farmer and consumer desire for ecologically sound technologies that are cost-effective and sustainable, meaning less choice in the marketplaces for seeds, inputs and foods.” – from a letter opposing the mergers signed by over 300 groups in the US.

Corporate consolidation increases the price of seed, decreases choice in the marketplace for Canadian farmers, and stifles research and development. These three impacts are the generally anticipated consequences of corporate consolidation in most sectors and observed trends in the seeds market over the past two decades in Canada and the US already point to these particular impacts. (Read CBAN’s Comments to Canada’s Competition Bureau, September 2016.)

The high level of corporate concentration in the seed market has already meant higher prices and limited choices for farmers. Legal controls, such as patents on genetic sequences, mean that farmers cannot reuse, save, share or sell GM seeds, but have to buy them from seed companies every year. Patented GM seeds are significantly more expensive than non-GM seed. (See CBAN’s report “Are GM Crops Better for Farmers?”)

A 2017 EU legal study set out five main reasons why European Union competition law should have required that the merger between Monsanto and Bayer be blocked:

1. High market concentration: Just three corporations (ChemChina-Syngenta, DuPont-Dow and Bayer-Monsanto) will own and sell about 64% of the world’s pesticides/ herbicides, and 60% of the world’s patented seeds.

2. Entrenched market power: Bayer held 206 patents and Monsanto 119 on transgenic plant traits in the EU, while Monsanto monopolized the US market with 96% of patented cotton traits. The risk of “anticompetitive collusion” is increased by the significant links the firms have, such as cross-licensing agreements, joint ventures, and other R&D strategic alliances.

3. Increased prices for farmers: The merger would “undoubtedly” raise costs and reduce the choice of seeds for farmers, with “considerable effects” on the viability of smallholder farming. Farmers “will pay the price of an increase in concentration in this sector”, pushed into a “take it or leave it” position.

4. Locking farmers in: Monsanto and Bayer’s combined forays into “digital farming” would position it as a fully-integrated service provider. An offer that once accepted would be virtually impossible for farmers to get out of, being dependent on the company for all inputs, down to the very data on their own soils and crops. Farmers would become dependent on three mega-corporations for all important decisions, “ceasing effectively to operate as independent economic actors.”

5. Reduced competition and innovation: The two companies are direct competitors in some areas, thereby removing competition and the incentive to innovate. The costs of competing with such new one-stop shop platforms may be prohibitively high for small and medium enterprises, which would instead be obliged to sell or license their technology to a merged Bayer-Monsanto corporation, allowing it to control the direction of technological change.

The study argued for the need to examine the full social and ecological costs of such corporate consolidation in the markets. For instance, the new mergers could make farmers less able and likely to farm sustainably. Farmers will increasingly lose control of seed materials, which “will have devastating effects on local varieties and non-standardised agricultural products”. Quantities of pesticides used by farmers can be expected to increase by the oligopoly of agrochemical giants promoting a high-input, high-tech, intensive monoculture model. This would have negative impacts on biodiversity, climate, and health. The political clout of a merged Bayer-Monsanto corporation would drown out alternative voices speaking for agro-ecological farming practices that boost biodiversity.

Companies also fund various public relations programs to promote public acceptance of their genetically engineered seeds and agrochemicals. Read more about corporate public relations campaigns here.

For information on the impacts of corporate control in seeds, see CBAN’s GMO Inquiry report “Are GM Crops Better for Farmers?”

Resources

- Jennifer Clapp and Keldon Bester, The Monopoly Problem at the Heart of Canada’s Food System, 2025

-

United Nations. 2025. Corporate power and human rights in food systems. Report of the Special Rapporteur on the Right to Food, Michael Fakhri, A/80/213.

-

ETC Group and GRAIN. 2025. Top 10 agribusiness giants: Corporate concentration in food & farming in 2025.

- US Department of Agriculture. 2023. Concentration and Competition in U.S. Agribusiness.

- ETC Group, November 2019: Plate Techtonics: Mapping corporate power in Big Food, Corporate concentration by sector and industry rankings by 2018 revenue.

- ETC Group, August 2018: Blocking the chain: Industrial food chain concentration, Big Data platforms and food sovereignty solutions.

- ETC Group (in partnership with IPES Food), 2017: Too Big to Feed: The Short Report – Mega-mergers and the concentration of power in the agri-food sector: How dominant firms have become too big to feed humanity sustainably.

- ETC Group, May 2015: Monsanto/Syngenta: From Gene Giants to Agribehemoths

- CBAN: “Are GM Crops Better for Farmers?” GMO Inquiry, 2015.

- ETC Group, March 2013: Gene Giants Seek “Philanthrogopoly” The report takes a look at how the 6 multinational Gene Giants control the current priorities and future direction of agriculture research worldwide.

- ETC Group, December 2011: Who Will Control the Green Economy? This report connects the dots between the climate and oil crises, new technologies and corporate power. The report warns that the world’s largest companies are riding the coattails of the “Green Economy” while gearing up for their boldest coup to-date – not just by making strategic acquisitions and tapping new markets, but also by penetrating new industrial sectors. DuPont, for example, already the world’s second largest seed company and sixth largest company in both pesticides and chemicals, is now a powerhouse in plant-based materials, energy and food ingredients. Other major players like Monsanto, Syngenta, Dow, BASF and Unilever are making strategic investments in risky technologies in hopes of turning plant biomass into products and profit.

- ETC Group, October 2010: Gene Giants Stockpile Patents on “Climate-Ready” Crops in Bid to Become Biomassters: Patent Grab Threatens Biodiversity, Food Sovereignty. Under the guise of developing “climate-ready” crops, the world’s largest seed and agrochemical corporations are filing hundreds of sweeping, multi-genome patents in a bid to control the world’s plant biomass. ETC Group identifies over 262 patent families, subsuming 1663 patent documents published worldwide (both applications and issued patents) that make specific claims on environmental stress tolerance in plants (such as drought, heat, flood, cold, salt tolerance). DuPont, Monsanto, BASF, Bayer, Syngenta and their biotech partners account for three-quarters (77%) of the patent families identified. Just three companies – DuPont, BASF, Monsanto – account for over two-thirds of the total. Public sector researchers hold only 10%.

Resources on mergers:

- CBAN’s Comments to Canada’s Competition Bureau objecting to the Bayer-Monsanto merger, September 2016.

- Summary briefing of Lianos, Ioannis with Katalevsky, Dmitry, Merger Activity in the Factors of Production Segments of the Food Value Chain: A Critical Assessment of the Bayer/Monsanto merger, Centre for Law, Economics and Society (CLES), University College London (UCL), Policy Paper Series: 1/2017, ISBN 978-1-910801-13-0 2

- American Antitrust Institute, Food & Water Watch and the National Farmers Union USA, The Proposed Dow-Dupont Merger, May 2016